Maximize Your Savings with the Savetaxs Income Tax Calculator

With the latest changes in the Union Budget and tax law, understanding your tax liability for FY 2025-26 (Assessment Year 2026-27) has never been more important. Hundreds of thousands of salaried individuals, NRIs, and tax-paying citizens are asking: Which tax regime is more beneficial? What deductions can I claim? How much will I really pay in income tax? That’s where the Savetaxs Income Tax Calculator steps in—free, accurate, and easy to use.

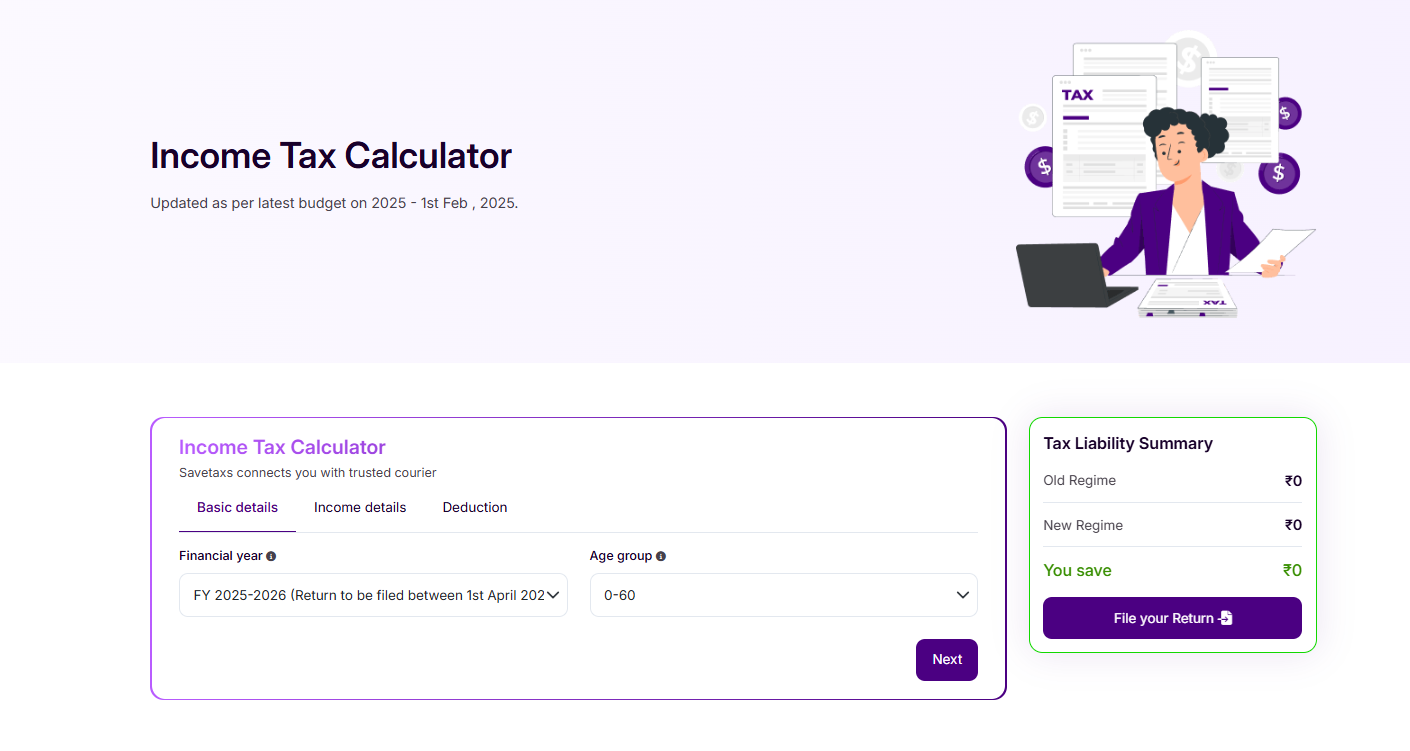

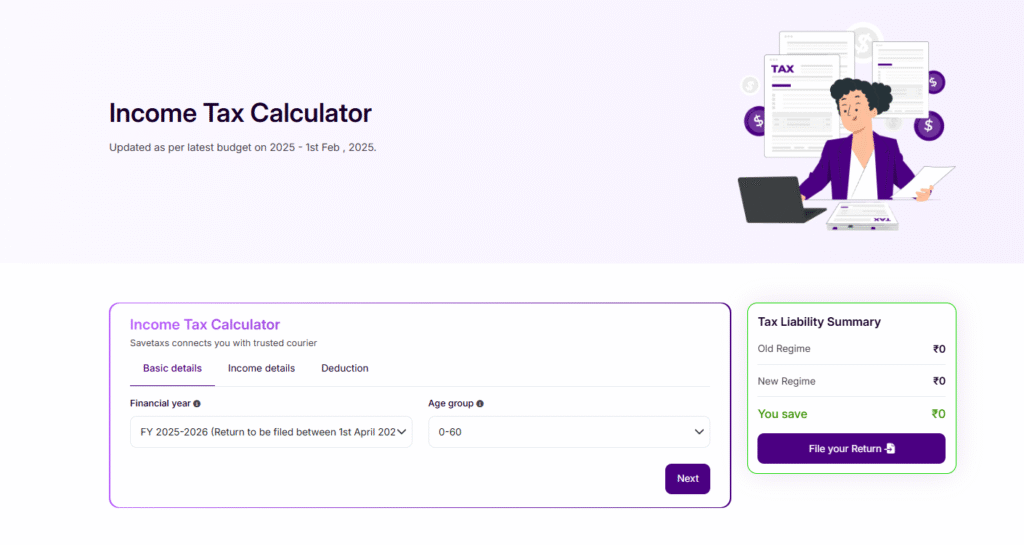

What Is the Savetaxs Income Tax Calculator?

Savetaxs offers a user-friendly online income tax calculator designed to compute your tax liability under both the old tax regime and the new regime. It takes into account your income, age group, deductions, and investments. Updated with the latest tax slabs and rebate details announced in the Budget 2025, this tool helps you plan your finances with confidence and make smarter decisions.

Why Use an Online Income Tax Calculator?

- Instant Tax Estimates: Enter your income and deductions, and get your tax liability within moments. No manual calculations or charts needed.

- Compare Old vs New Regime: Since recent tax changes provide both old and new regime options, it’s crucial to see which one saves you more. Savetaxs makes this comparison side by side.

- Transparency and Accuracy: Everything is updated to the FY 2025-26 tax rules. You don’t need to dig through the Budget documents or worry about missing a clause.

- Accessible & Free: The calculator is free to use, available anytime, from anywhere—perfect for salaried employees, self-employed professionals, and NRIs alike.

How It Works: Step-by-Step

Here’s how you can get started with the Savetaxs Income Tax Calculator:

- Select the Financial Year: Choose FY 2024-25 or FY 2025-26 (depending on which assessment year you are preparing for).

- Enter Age Group: Tax slabs and exemption limits differ for people under 60, between 60-79, and 80+.

- Income Details:

- Salary income (basic, allowances, etc.)

- Exempt allowances

- Interest income, other income sources like rent or digital assets

- Rent from let-out property or self-occupied home loan interest where applicable

- Deductions & Investments:

- Section 80C (PPF, ELSS, LIC, etc.)

- Medicines / health insurance under 80D

- Donations under 80G

- Interest on housing loan under 80EEA

- Employee or employer’s contribution to NPS (80CCD)

- Interest income from savings accounts (80TTA)

- Calculate & Compare: Once all fields are filled, click “Calculate” to see your tax liability under both the old regime and the new regime. The tool also displays how much you save (if any) by choosing one regime over the other.

Tax Slabs & Regimes for FY 2025-26

Here are the current tax slabs (new regime) for FY 2025-26:

| Income Range | Rate |

|---|---|

| Up to ₹4,00,000 | NIL |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Plus, a rebate of ₹60,000 is applicable for incomes up to a certain threshold under the new regime.

Also remember: surcharge and health & education cess (4%) are added when income exceeds certain limits.

Who Can Benefit From This Calculator?

- Salaried Individuals: Especially those receiving HRA, allowances, or having multiple income sources.

- NRIs / RNORs: For estimating tax on India-sourced income like NRO interest, rental income, etc. SaveTaxs supports these with adjustments where needed.

- Investors & House Owners: If you have home loan interest, investments under Section 80, or other deductions, you’ll benefit by knowing which regime maximizes savings.

- Freelancers / Self-Employed: For intake from various streams: digital assets, rent, or other incomes. This tool captures “other income” and digital assets too.

Real-World Example: How Much Can You Save?

Imagine Jiya works in Delhi. She has a monthly salary, HRA, special allowance, plus rent, LTA, and other incomes. Using the SaveTaxs calculator, she enters her entire income from salary and other sources, fills in deductions such as 80C, 80D, 80TTA, and the tool computes:

- Under the old regime, lower standard deduction, many deductions available

- Under the new regime, higher standard deduction but fewer permissible deductions

The calculator shows that under one regime she pays less tax, and the amount she “saves” by opting for it. This helps her decide optimally.

Common Questions & Clarifications

- Is it free? Yes, the tool is free and doesn’t require login or subscription for basic estimates.

- Do I need to calculate TDS separately? Yes. The calculator estimates your total tax liability but not TDS deductions. For TDS calculations, Savetaxs offers a separate TDS calculator.

- Is it updated as per the latest budget? Yes. The calculator reflects the FY 2025-26 tax slabs and latest rules from Budget 2025.

Final Word: Why You Should Use Savetaxs Calculator

If you want to optimize your tax savings, plan your investments smartly, or simply avoid any surprises when filing your ITR, using a reliable tool like the Savetaxs Income Tax Calculator is indispensable. It’s fast, modern, accurate, and tailored to the newest tax rules. Whether you’re assessing whether to stick with the old regime or switch to the new one, or figuring out how deductions can affect your tax liability. this calculator gives you the roadmap.

Don’t wait until the last minute. Try the Savetaxs Income Tax Calculator today, enter your details, compare regimes, understand your obligations and make tax season work for your benefit.